BISP Disqualified in 2025

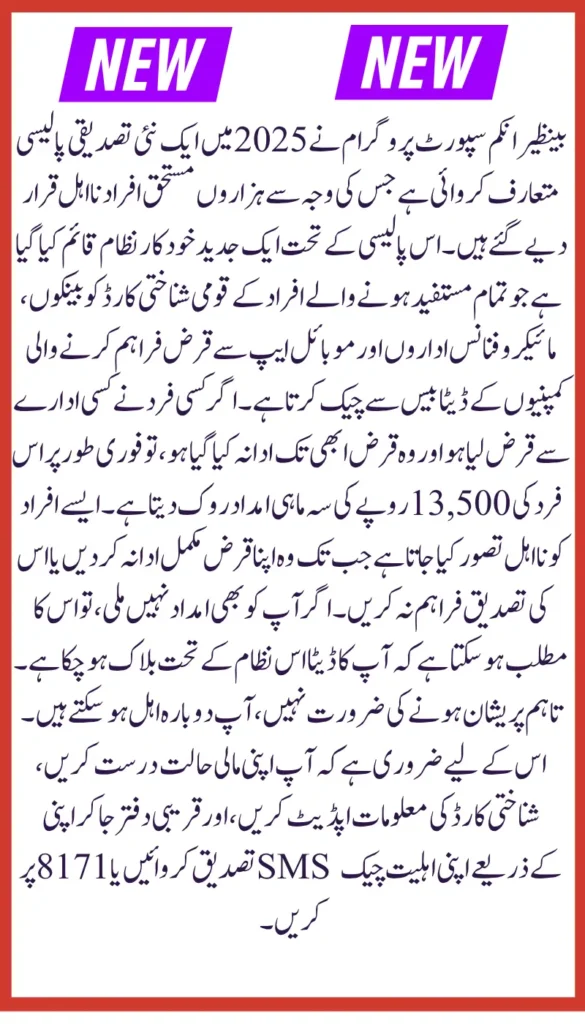

BISP Disqualified in 2025.BISP has introduced a new verification policy in 2025, which has resulted in an apology in their favor. If you have also missed out on the quarterly assistance of Rs 13,500, then this is for you. It explains the BISP rules, new rules, and how to get eligible back in full detail.

What is BISP – New Policy 2025?

Under the new policy 2025, BISP has set up a modern verification system that automatically checks the National Identity Card Number (CNIC) of all beneficiaries against the database of banks, microfinance institutions and mobile app lenders. If an individual has taken a loan and failed to repay it, the BISP installment is stopped immediately, and if you cannot guarantee it.

BISP Success 2025 Important

If your BISP payment has been stopped, the following reasons may apply:

- Non-repayment of the principal amount: If you have taken a loan from a bank, microfinance institution, or lending mobile app and have not repaid it on time.

- Provision of incorrect or incomplete information: Incorrect information provided at the time of BISP registration such as family records or home status.

- Domestic travel: Going to the country for Hajj, Umrah or sightseeing, which is considered a sign of financial stability.

Punjab Housing Scheme 2025 Phase 5 – Apni Chhat Apna Ghar Latest Update

- CNIC Expiration: If your CNIC expires and you have not renewed it.

- Good news: If you have provided incorrect or misleading documents at the time of registration or verification.

All this data is being checked automatically in the BISP system and may not involve any human intervention.

How Does The New BISP loan Filter Work?

The 2025 BISP system includes a “loan filter” an advanced and automated system that links CNIC with various financial institutions. The procedure is as follows:

- The data of each CNIC is checked with the loan records of banks and financial institutions.

- If the loan remains unpaid, the system autonomously flags the individual as a “credit defaulter.”

- After this, the BISP installment is stopped, and no officer has the authority to restore it until the loan is fully repaid.

How to Re-Eligible? (Eligibility Process)

If you are declared, don’t worry, you can re-eligible and re-take the installment of Rs. 13,500 Follow the steps below:

- Check BISP 8th Set Online 171 from the web portal or BISP office.

- They were the ones who created this note, the system itself considered them “defaulters”

- Go to BISP Tehsil Office and submit the form for re-registration.

- Correct your information like CNIC, family record, and data details.

- Attach payment papers with the correction form to verify eligibility again.

Is This Policy Affecting?

This new policy is especially affecting women:

- Borrowed money from loan apps and did not return it.

- Providing wrong home or financial information

- Abroad

- CNIC is not getting renewed

This system is only designed to provide financial assistance to people so that it is authentic and there is no misuse of the administration.

Conclusion

After registering for BISP Disqualified in 2025, all applicants must keep their financial information accurate, debt-free, and up-to-date. If you want to be eligible, you can take the right steps and become eligible again. For more, you can send an SMS to 8171.

BISP 13500 Payment 2025: NSER Survey Mandatory for Unverified and New Registrations